ker Energy, a Norwegian E&P firm, with the license to explore and produce oil at the DWT/CTP block, is expected to resume its Ghana development agenda in 2021, under a revised Plan of Development (PoD) -with an entirely different technical approach.

“It is a completely new technical project that takes into account the persistent low oil prices. We all know oil prices will struggle in the coming years, so the idea is to come up with a plan that is commercially and technically viable,” a competent industry source told Offshore Africa. “It is a much simpler project, nothing complex or sophisticated about the new plan.” Bidding for long lead-in items, such as an FPSO, is due to start in the next few months. Under the revised Petroleum Agreement, approved by the Ghanaian parliament at the end of 2019, Aker Energy is not required by law to submit the new plan to the Ghana Government for approval.

Article 8.16A gives Aker Energy the right to amend, vary or adjust its development plan without the consent of the Minister. It says, “Contractor (Aker Energy) shall have the right to amend, vary or adjust their Development Plan within twelve months of the final investment decision by Contractor without the consent of the Minister, provided such amendment, variation or adjustment shall not result in an increase in total capital expenditure in respect of the Pecan field.”

Restrictions on a range of key issues; from local content requirements to approval of key decisions, were all relaxed by the authorities in Accra. Aker Energy announced the suspension of Final Investment Decision (FID) for the Pecan project in early 2020, months after Ghana had granted unprecedented concessions to facilitate the $4.2 billion project.

Ghana hopes to add 100,000 bopd to its current oil production level when production from Pecan field commences. Production at Ghana’s flagship Jubilee field is expected to decline in 2021, according to the Bank of Ghana.

Highly placed sources, who are privy to Aker Energy’s new development plan, say it is radically different from the initial plan and may not fulfil long-held expectations, particularly among Ghanaian stakeholders.

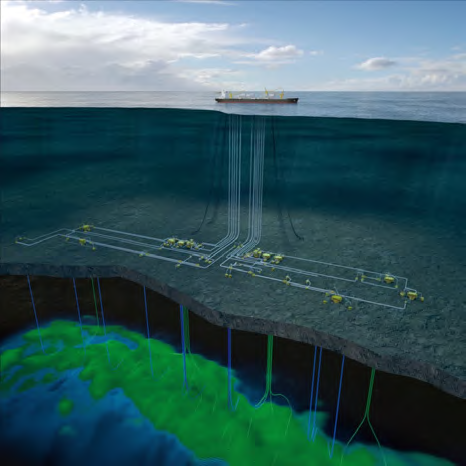

A report by Rystad Energy on the offshore Pecan project estimated that the 300 million-barrel field will be profitable when oil sells at $49 a barrel. Aker Energy says proven resources are estimated to be between 450 and 500 million barrels. The company says it sees a potential in the area of up to one billion barrels in reserves. And while resources from satellite fields are factored into the production equation, Aker Energy says it could achieve a balanced price of around $30 per barrel. But the Norwegian firm says it is focused on making the field development economical on a stand-alone basis, not counting surrounding reserves. Aker Energy’s CEO Sven Jakob Likness had announced farreaching changes to the initial plan of development, starting with the design of FPSO. “Aker Energy will also consider changes to the subsea plant on the seabed, and whether new technology can improve the project economy.” The previous field development plan submitted to Ghana’s Ministry of Energy had plans for up to 26 subsea wells, including 14 advanced, horizontal oil producers and 12 injectors with alternating water and gas injection (WAG) and the use of multiphase pumps as artificial lift, to maximise oil production.

Analysts say the recent election win by the NPP-led administration may also have contributed to the decision by Aker Energy to resume operations in Ghana’s promising upstream petroleum sector. However, concerns are also emerging about Ghana’s unpreparedness to deal with the debilitating impact of energy transition. Aker Energy is operator of the DWT/CTP block with 50 percent ownership. Partners include Lukoil with 38 percent, GNPC 10 percent and Fuel Trade (2 percent).